Responsible Investment Advisory Group (“RIAG”) and Climate Change

In 2021, following a formal review, the Board of Trustees approved a broad set of actions for the endowment related to the climate change crisis. These actions included: divestment from direct holdings of the largest coal and tar sands reserves companies, a commitment to make positive impact investments aimed at climate change mitigation and adaptation, a commitment to work with the endowment’s investment partners to continue their progress on climate change and broader ESG goals, enhanced reporting on the endowment’s progress toward these measures, and a formal review on progress made and consideration of additional steps in a few years’ time. Read the 2021 RIAG report from the Board of Trustees.

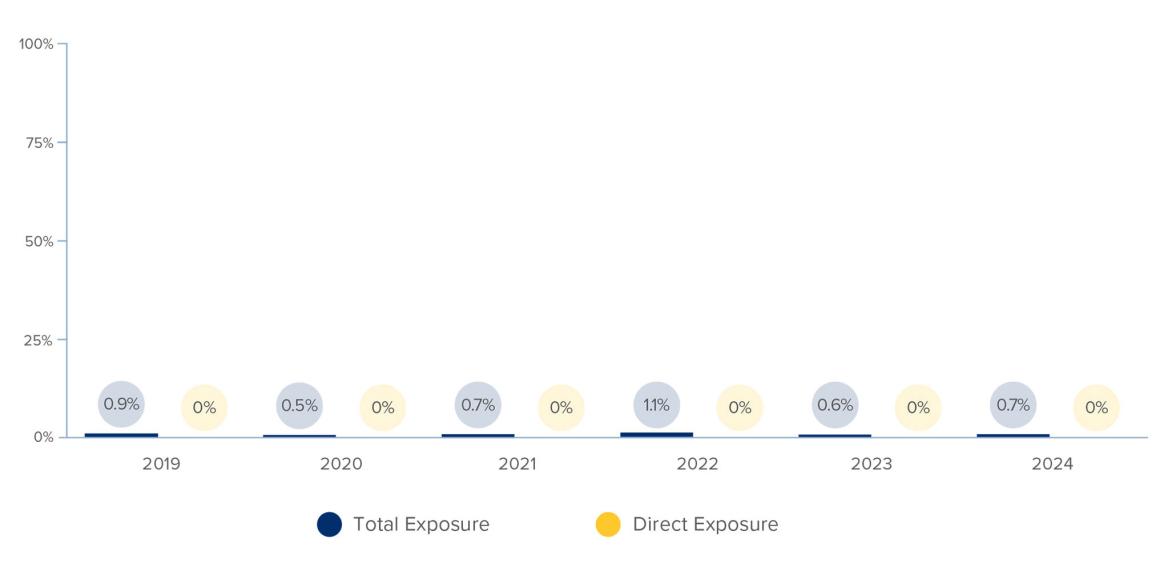

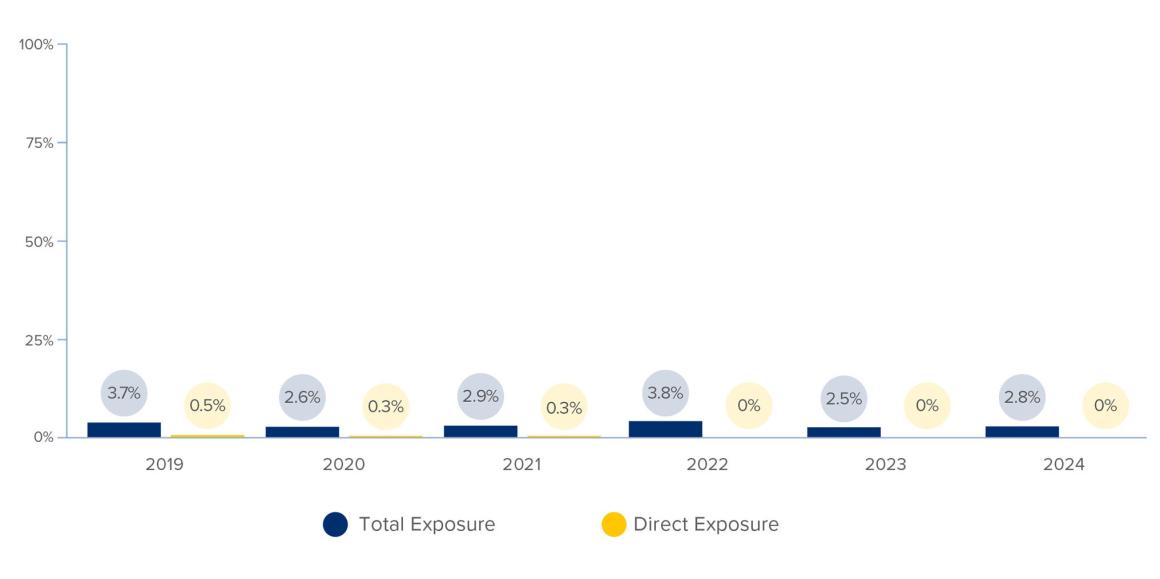

With the adoption of the 2021 RIAG recommendations, the Board of Trustees identified coal and tar sands reserves as a primary contributor to the future release of greenhouse gases into the atmosphere. The Investment Office has partnered with a leading data analytics provider in this space to identify the 100 largest coal reserve owners and 20 largest tar sands reserve owners in the world. This list is updated annually, and the endowment is restricted from direct holdings in these companies through internally managed accounts. In addition, the Investment Office will continue to seek ways to reduce indirect exposures to these companies in the endowment. The data below reflects the portfolio exposure to these companies over recent years. Finally, the Board of Trustees directed the Investment Office to invest a minimum of $10 million over the next five years in positive impact funds and companies whose primary focus is on activities that mitigate or are adaptive to the impacts of climate change. In fiscal year 2021, the following positive impact investments were made:

- $25 million in commitments to a private infrastructure fund.

- An $8 million commitment to a venture capital/growth equity climate change fund, which invests in companies that provide technologies and services required to meet carbon-neutrality objectives.

- A $30 million investment in California Carbon Allowances market (CCAs), a key element of California’s cap-n-trade program aimed at reducing GHG emissions. In addition, state revenue from this program go into the state’s Greenhouse Gas Reduction Fund, 35% of which is directed to environmentally disadvantaged and low-income communities.