Environmental, Social, and Governance (ESG) and Diversity, Equity, Inclusion, and Justice (DEIJ) Considerations

Tufts has a long history of leadership within higher education on issues of social consciousness and this commitment extends to the endowment assets. This page outlines the Investment Office's commitment to diversity, equity, inclusion and justice issues and the integration of environmental, social and governance considerations into our investment process.

DEIJ Commitment

Tufts aims to be an inclusive institution dedicated to achieving greater diversity among its students, faculty, and staff. The Investment Office is committed to upholding Tufts' values of diversity, equity and inclusion in our interactions as a team, with our partners, and with the wider investment community. We embrace diverse perspectives within our own ranks to make better decisions and seek diverse expertise in our partners to drive long-term outperformance. Our underwriting process for investment partners includes an assessment of their culture and processes through the lens of diversity, equity, inclusion and justice (DEIJ) and we conduct an annual review of our manager's DEIJ practices to monitor progress over time. Our goal is to lead by example and promote greater gender and racial diversity in the investment management industry.

ESG Statement

The Investment Office conducts long-term investing to provide current and future financial support critical to the university's academic and research mission. With a focus on maximizing returns over the long term, the Investment Office thoughtfully considers all investment risks and opportunities that could materially impact the endowment's returns. Our underwriting process includes an environmental, social and governance (ESG) assessment of each potential investment as we believe that ESG factors can signal operational, regulatory, or reputational risks or long-term value creation opportunities. Recognizing that climate change and resource depletion are among the most consequential challenges of our time, Tufts is committed to being a responsible steward of the physical environment. The University is aiming for carbon neutrality by 2050 and the Investment Office has made return-driven positive impact investments through the endowment that help mitigate or support society's adaptation to the negative effects of climate change. Examples of Tufts' leadership include:

- In 2015, the Board of Trustees launched the Tufts University Sustainability Fund (TUSF), a distinct endowment portfolio with an ESG investment mandate, allowing donors to direct their gifts toward these investments.

- In 2020, the Omidyar-Tufts Active Citizenship Trust (OT-ACT) broadened its investment focus to incorporate positive impact on a range of societal issues including, but not limited to, financial and economic inclusion, health and wellness, affordable housing, and access to energy, water, and education.

- In 2021, following a formal review, the Board of Trustees approved a broad set of actions for the endowment related to the climate change crisis. Read more about these actions.

- In 2022, following a generous alumni gift, Tufts created a graduate certificate program in Environmental, Social, and Governance (ESG) investing. Read more about this and other sustainable investing resources and opportunities at Tufts.

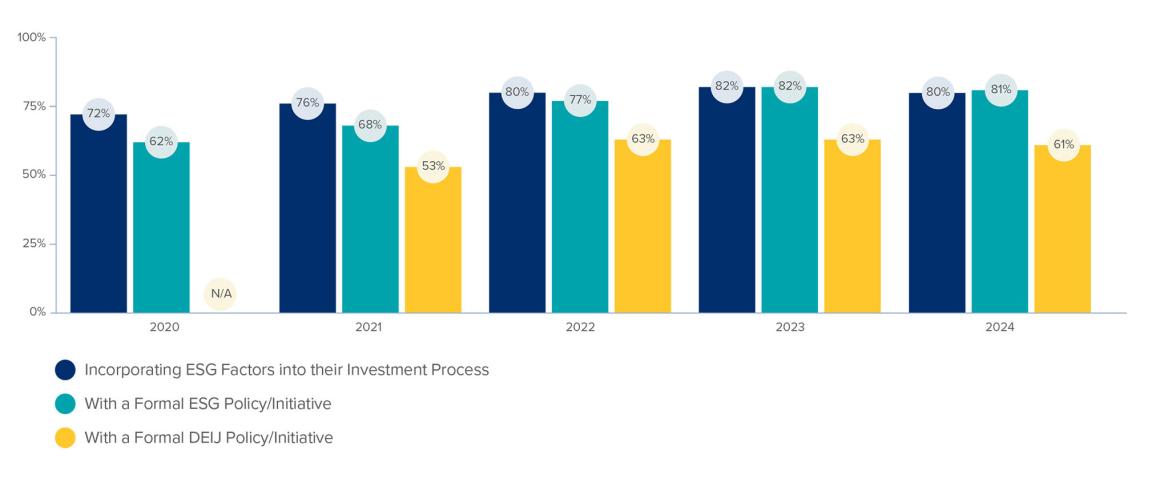

In recent years, the Investment Office has initiated an annual survey of its investment partners to assess the level to which ESG and DEIJ are incorporated into its partners' investment processes. With this information, the Investment Office can begin to formally track the progress made by its partners and have productive conversations about how each can make additional improvements on these dimensions over time. The summary results of this survey are highlighted below.

Percentage of External Managers...

Private Prisons

In June 2021, members of the Tufts Community Union Senate and Tufts for a Racially Equitable Endowment proposed the formation of a Responsible Investment Advisory Group (RIAG) to consider the possibility of the university's divestment from investments in private prisons. Following careful review and extensive deliberations, the university concluded that a RIAG on the issue of private prisons was not warranted at that time for a few reasons, including:

- The endowment has not held and does not expect to hold any direct investments in private prisons.

- At the time of the request, the endowment held no indirect exposure to private prisons. Historically, the endowment had negligible exposure to private prisons–less than 0.003% of assets–through commingled funds.

- There are no obvious positive impact investments to be made by the endowment to promote alternative solutions to private prisons, as was the case for coal and tar sands companies.

Tufts recognizes that private prisons deserve continued scrutiny and are a part of a much broader issue of mass incarceration and raise serious questions concerning social and racial justice in our country. Political action, community engagement, and public discourse offer the best path toward social change on this issue.